5 Signs Its Time to Refinance Your Home Mortgage

5 Signs It’s Time to Refinance Your Home Mortgage: Unlocking significant savings and optimizing your financial future isn’t always obvious. Navigating the complexities of home mortgage refinancing can feel daunting, but understanding the key indicators can pave the way for substantial benefits. This guide unveils five crucial signs that suggest it’s the perfect time to explore refinancing your home loan, empowering you to make informed decisions and potentially save thousands.

Let’s dive into the strategies that could dramatically reshape your mortgage landscape.

Refinancing your mortgage is essentially replacing your current home loan with a new one, often at a more favorable interest rate or with improved terms. Historically, refinancing has been a powerful tool for homeowners seeking to reduce their monthly payments, shorten their loan term, or consolidate debt. The right time to refinance hinges on a combination of factors, and understanding these factors is key to maximizing the potential benefits.

We’ll examine these crucial indicators in detail, providing you with the insights you need to make a well-informed choice.

Understanding Home Mortgage Refinancing

Refinancing your home mortgage is essentially replacing your existing mortgage with a new one. Think of it like trading in your old car for a newer model – you’re aiming for better terms, potentially lower monthly payments, or a different loan structure. It’s a powerful financial tool, but like any financial decision, it requires careful consideration.The practice of refinancing mortgages has a long history, evolving alongside the broader mortgage market.

Early forms of refinancing were often driven by fluctuating interest rates. As interest rates fell, homeowners saw an opportunity to reduce their monthly payments by securing a new mortgage at a lower rate. This practice became increasingly sophisticated with the development of various mortgage products and the rise of the secondary mortgage market, allowing for greater liquidity and competition among lenders.Three common motivations for homeowners to refinance are lower interest rates, shorter loan terms, and debt consolidation.

Lower interest rates are the most frequent driver. A drop in prevailing interest rates can translate to substantial savings over the life of the loan, leading many homeowners to seek a new mortgage at a more favorable rate. Shortening the loan term, on the other hand, means paying off the principal faster, ultimately saving on interest in the long run, even if the monthly payment increases slightly.

Finally, refinancing can provide a convenient way to consolidate high-interest debts, such as credit card balances, into a lower-interest mortgage, simplifying repayment and potentially lowering overall interest costs.

Reasons for Refinancing: Lower Interest Rates

Lower interest rates are often the primary catalyst for refinancing. For example, if a homeowner secured a 30-year mortgage at 7% interest in 2022, and rates drop to 5% in 2024, refinancing could significantly reduce their monthly payment and save them thousands of dollars over the remaining loan term. The savings depend on the loan amount, the difference in interest rates, and the remaining loan term.

A simple calculation, using an online mortgage calculator, can illustrate the potential savings.

Reasons for Refinancing: Shorter Loan Terms

Reducing the loan term, even with a slightly higher monthly payment, can lead to significant long-term savings on interest. For instance, switching from a 30-year mortgage to a 15-year mortgage means paying off the loan much faster, resulting in substantial interest savings. While the monthly payment will be higher, the overall cost of borrowing will be considerably less. This strategy is particularly beneficial for homeowners who have increased their income or have extra funds available to allocate towards faster mortgage repayment.

Reasons for Refinancing: Debt Consolidation

Debt consolidation through refinancing can streamline debt management and potentially reduce interest expenses. Homeowners with multiple high-interest debts, such as credit card balances or personal loans, can roll these debts into their mortgage, creating a single, lower-interest payment. This simplifies budgeting, reduces the risk of missed payments, and potentially lowers the overall interest burden, provided the new mortgage rate is significantly lower than the rates on the consolidated debts.

This approach, however, requires careful assessment of the total debt and the potential increase in the mortgage’s overall cost.

Significantly Lower Interest Rates

Refinancing your mortgage can unlock substantial savings, particularly when interest rates have dropped significantly since you secured your original loan. This isn’t just about a few dollars here and there; we’re talking about potentially thousands of dollars saved over the life of your loan. By carefully comparing current rates to your existing mortgage rate, you can determine if refinancing makes financial sense for your specific situation.

This involves more than just looking at the headline rate; you need to factor in closing costs and the overall impact on your monthly payments.A lower interest rate translates directly into lower monthly payments, freeing up cash flow for other financial goals. Moreover, these savings accumulate over time, compounding into a considerable sum by the end of your loan term.

Consider this: even a small reduction in your interest rate can significantly reduce the total interest paid over the life of your loan. This can free up capital for investments, debt reduction, or simply improving your quality of life.

Interest Rate Reduction and Monthly Payment Savings

The following table illustrates the potential monthly payment differences based on various interest rate reductions, assuming a $300,000 loan amount and a 30-year term. Remember, these are illustrative examples and your actual savings will depend on your specific loan amount, loan term, and the interest rates available to you. Always consult with a mortgage professional to get personalized figures.

| Original Interest Rate | New Interest Rate | Monthly Payment Difference | Total Interest Savings (30 years) |

|---|---|---|---|

| 7% | 5% | ~$300 | ~$60,000 |

| 6% | 4% | ~$180 | ~$36,000 |

| 5% | 3% | ~$100 | ~$20,000 |

| 4% | 2% | ~$50 | ~$10,000 |

Improved Mortgage Terms

Refinancing your mortgage isn’t just about securing a lower interest rate; it’s also a strategic opportunity to optimize your loan terms for long-term financial benefit. By carefully examining your current mortgage structure and comparing it to available refinancing options, you can potentially unlock significant savings and improve your overall financial health. Let’s explore how altering your mortgage terms can lead to substantial gains.Switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage offers predictable monthly payments and shields you from the volatility of fluctuating interest rates.

This stability is particularly valuable in uncertain economic climates, providing peace of mind and enhanced financial planning capabilities. Consider the example of a homeowner with an ARM whose rate has recently increased significantly, resulting in a substantial jump in their monthly payment. Refinancing to a fixed-rate mortgage would eliminate this risk and allow them to budget more effectively.

Switching from an ARM to a Fixed-Rate Mortgage

A fixed-rate mortgage offers predictable monthly payments for the life of the loan. This eliminates the risk associated with adjustable-rate mortgages, where interest rates can fluctuate, potentially leading to unpredictable and potentially unaffordable payments. The security of a fixed payment simplifies budgeting and long-term financial planning. For instance, imagine a homeowner with an ARM who experienced a rate increase that made their monthly payments unsustainable.

By refinancing into a fixed-rate mortgage, they secured a predictable payment, providing financial stability and reducing stress. The stability offered by a fixed-rate mortgage can also improve your credit score over time, as consistent on-time payments demonstrate financial responsibility to lenders.

Shortening the Loan Term, 5 Signs It’s Time to Refinance Your Home Mortgage

Reducing your loan term, for example, from a 30-year mortgage to a 15-year mortgage, will result in higher monthly payments. However, this strategy significantly reduces the total interest paid over the life of the loan, leading to substantial long-term savings. For example, a $300,000 mortgage at 4% interest over 30 years would accumulate approximately $175,000 in interest. The same loan over 15 years would only accrue roughly $75,000 in interest, saving $100,000.

While the higher monthly payments may initially seem daunting, the accelerated payoff and reduced interest expense are compelling benefits for those prioritizing long-term financial efficiency. This approach is particularly advantageous for homeowners with stable income and a strong commitment to accelerated debt reduction.

Potential Drawbacks of Changing Mortgage Terms

While altering your mortgage terms can yield significant advantages, it’s crucial to acknowledge potential drawbacks. The most prominent is the increase in monthly payments associated with shortening the loan term. A shorter-term loan, while saving money on interest, necessitates a larger monthly payment. Careful consideration of your current budget and financial capabilities is essential to ensure you can comfortably manage the increased payment obligations.

Furthermore, there are closing costs associated with refinancing, which should be factored into your decision. These costs can vary depending on the lender and the specifics of the refinancing transaction. A thorough analysis of the total cost of refinancing, including closing costs and the potential for long-term savings, is crucial for making an informed decision.

Significant Home Equity Buildup: 5 Signs It’s Time To Refinance Your Home Mortgage

Building substantial home equity is a powerful lever in the refinancing process, often unlocking significantly better loan terms and lower monthly payments. Understanding how equity accumulates and its impact on your refinancing options is key to making informed financial decisions. Essentially, home equity represents the difference between your home’s current market value and the amount you still owe on your mortgage.

As you make consistent mortgage payments and your home appreciates in value, your equity grows. This growth creates a stronger financial foundation for securing a more favorable refinance.Home equity’s importance in refinancing stems from its role as collateral. Lenders assess your risk when considering a refinance application, and higher equity demonstrates a lower risk to them. A larger equity cushion means you have more “skin in the game,” making you a more attractive borrower.

This can translate into better interest rates, lower fees, and even access to loan products that might otherwise be unavailable.

Increased Equity Leading to Better Loan Terms

Significant home equity directly impacts the terms of your refinance. Imagine you initially purchased your home for $300,000 with a 20% down payment ($60,000). After several years of consistent payments and a modest increase in home value, your home is now appraised at $360,000, and you’ve paid down your mortgage principal to $200,000. Your equity is now $160,000 ($360,000 – $200,000), representing a significant increase from your initial equity.

This substantial equity makes you a lower-risk borrower, increasing your chances of securing a better interest rate, potentially lowering your monthly payments by hundreds of dollars. Furthermore, a higher loan-to-value ratio (LTV) – the ratio of your mortgage to your home’s value – opens doors to various refinance options, such as cash-out refinances to consolidate debt or fund home improvements.

Illustrative Refinancing Scenario

Let’s consider a homeowner with a $250,000 mortgage on a home initially valued at $300,000. After five years of payments and market appreciation, the home’s value increases to $400,000, and the remaining mortgage balance is $180,000. This homeowner now has $220,000 in equity ($400,000 – $180,000). With such substantial equity, the homeowner could refinance at a lower interest rate, perhaps securing a 15-year mortgage instead of their current 30-year mortgage.

This could significantly reduce the total interest paid over the life of the loan, saving thousands of dollars. Additionally, the lower LTV (45%) compared to their initial LTV (83%) may eliminate the need for Private Mortgage Insurance (PMI), resulting in further monthly savings. This scenario underscores how building substantial home equity can translate into tangible financial benefits through refinancing.

Changing Financial Circumstances

Refinancing your mortgage isn’t just about chasing lower interest rates; it’s also about aligning your mortgage with your evolving financial picture. Life throws curveballs – a new job, marriage, or the arrival of children can significantly impact your financial stability and, consequently, your mortgage suitability. Understanding how these changes influence your mortgage needs is crucial in determining whether refinancing is the right move.A shift in your financial landscape can dramatically alter your mortgage’s feasibility and long-term affordability.

Consider a scenario where a couple, initially on a single income, marries and experiences a combined income increase. This newfound financial stability might allow them to qualify for a larger loan amount or a shorter loan term, potentially reducing their overall interest payments. Conversely, a job loss or unexpected medical expenses could necessitate refinancing to secure a more manageable monthly payment or a lower interest rate to improve cash flow.

Navigating these changes effectively requires a careful assessment of your current situation and its implications for your mortgage.

Income Changes and Refinancing Decisions

Income fluctuations are a major factor influencing refinancing decisions. A substantial increase in income might empower you to qualify for a better interest rate, a shorter loan term, or even a larger loan amount for home improvements. Conversely, a decrease in income might necessitate refinancing to a lower monthly payment to avoid potential financial strain. Think of it like this: your income is the engine of your financial vehicle; your mortgage is the vehicle itself.

If the engine’s power changes, you might need to adjust the vehicle to maintain a smooth and efficient ride. For example, a promotion resulting in a 20% salary increase could significantly improve your debt-to-income ratio, making you a more attractive candidate for a better refinance deal. On the other hand, an unexpected job loss might necessitate refinancing to a lower payment, perhaps by extending the loan term or switching to an interest-only payment plan (though this should be carefully considered for long-term financial health).

Financial Circumstances Justifying Refinancing

It’s important to carefully consider your circumstances before making a refinancing decision. Here are some situations where refinancing might be a beneficial step:

- Significant increase in income leading to improved debt-to-income ratio.

- Job change resulting in a higher salary or greater job security.

- Marriage or partnership leading to combined income and improved financial stability.

- Birth of a child, requiring adjustments to household budget and expenses.

- Unexpected medical expenses or significant debt consolidation needs.

- Significant home equity buildup, enabling access to better refinancing options.

- Desire to shorten loan term to reduce overall interest paid.

- Falling interest rates presenting opportunities for substantial savings.

Debt Consolidation Opportunities

Refinancing your mortgage presents a powerful opportunity often overlooked: debt consolidation. By leveraging your home’s equity, you can potentially roll high-interest debts, like credit cards or personal loans, into your mortgage, significantly reducing your overall monthly payments and accelerating your path to financial freedom. This strategic move can streamline your finances and dramatically improve your long-term financial health.Refinancing allows you to consolidate multiple debts into a single, lower-interest payment.

This simplification simplifies budgeting, reduces the risk of missed payments, and frees up cash flow for other financial goals, such as saving for retirement or investing in your future. The key lies in securing a refinance rate lower than your current debt interest rates. Consider this a powerful financial lever – a way to turn a high-cost liability into a more manageable long-term asset.

Debt Consolidation Savings

Let’s examine the potential savings. Imagine you have $30,000 in credit card debt with an average interest rate of 18%. Your monthly payments are substantial, eating into your disposable income. By refinancing your mortgage and including this debt, you might secure a new mortgage with a 6% interest rate. This significantly reduces your monthly interest burden, freeing up considerable cash flow.

The difference between these interest rates translates directly into substantial savings over the life of the loan.

Comparative Analysis of Debt Consolidation

The following table illustrates a comparison of managing debt before and after refinancing for debt consolidation. Note that these are illustrative examples and actual savings will vary depending on individual circumstances and interest rates.

| Scenario | Debt Amount | Interest Rate | Monthly Payment |

|---|---|---|---|

| High-Interest Credit Cards (Before Refinancing) | $30,000 | 18% | $1,000 (approx.) |

| Refinanced Mortgage (After Refinancing) | $30,000 (included in mortgage) | 6% | $300 – $400 (approx. depending on loan term) |

This table showcases a substantial reduction in monthly payments. The exact figures depend on your specific loan terms, the amount of debt consolidated, and the interest rate you secure on your refinanced mortgage. However, the potential for substantial savings is clear. Remember to carefully analyze all associated costs, including closing costs, before making a decision. Seeking professional financial advice can further enhance the clarity and effectiveness of your debt consolidation strategy.

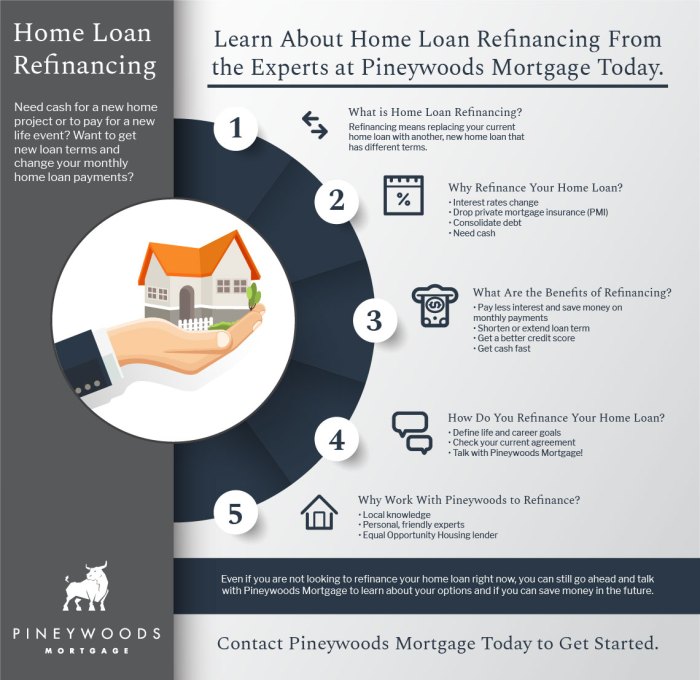

Visual Aid

Understanding the potential savings from refinancing can be significantly enhanced through visual representations. Charts and graphs effectively communicate complex financial information, making it easier to grasp the benefits and make informed decisions. Let’s explore how visual aids can illuminate the financial advantages of refinancing your home mortgage.A compelling way to showcase the impact of refinancing is through a comparative chart illustrating monthly payments before and after the refinancing process.

This allows for a direct, side-by-side comparison, highlighting the tangible reduction in monthly expenses.

Monthly Payment Comparison Chart

Imagine a chart with two columns: “Before Refinancing” and “After Refinancing.” The rows would represent key data points. For example, let’s assume an initial mortgage of $300,000 with a 30-year term at a 7% interest rate. The monthly payment would be approximately $2,000. Now, let’s say the homeowner refinances to a 15-year term at a 5% interest rate.

The new monthly payment might be around $2,400. However, despite the higher monthly payment, the overall interest paid will be significantly lower, as we will see later. The chart would clearly show the initial higher monthly payment ($2,000) against the slightly higher but ultimately more beneficial payment of $2,400. This illustrates the trade-off between a higher monthly payment and significantly reduced total interest paid over the life of the loan.

The difference, even if small on a monthly basis, adds up to substantial savings over the life of the loan. For instance, the difference between $2,000 and $2,400 is $400 per month, or $4800 per year. Over the 15-year loan term, this amounts to a considerable sum.

Illustration of Reduced Total Interest Paid

Consider an image depicting two distinct lines representing the total interest paid over the life of the loan. One line, representing the original mortgage, would show a steep, upward trajectory, illustrating the substantial interest accumulated over 30 years. The other line, representing the refinanced mortgage, would show a significantly lower upward trajectory, clearly demonstrating the reduced total interest paid due to the lower interest rate and shorter loan term.

The visual difference would be striking, powerfully illustrating the long-term cost savings achieved through refinancing. Let’s assume, based on the figures above, that the original mortgage would accumulate approximately $240,000 in interest over 30 years. In contrast, the refinanced mortgage, with its lower interest rate and shorter term, might only accumulate approximately $100,000 in interest. The image would visually represent this $140,000 difference – a substantial saving that clearly outweighs the marginally higher monthly payment.

This visual representation provides a powerful argument for the long-term financial benefits of refinancing.

Final Wrap-Up

Ultimately, the decision to refinance your home mortgage is a personal one, deeply intertwined with your unique financial circumstances and long-term goals. By carefully considering the five key signs Artikeld above—significantly lower interest rates, improved mortgage terms, significant home equity buildup, changing financial circumstances, and debt consolidation opportunities—you can make a confident and strategic choice. Remember, proactive financial planning can lead to substantial long-term savings and peace of mind.

Don’t hesitate to consult with a qualified financial advisor to personalize your strategy and ensure you’re making the best decision for your individual needs.